2025 ushers in a new era of healthcare curiosity in the United States, as Google Trends reports a remarkable uptick in searches for weight-management prescription drugs Zepbound and Wegovy.

NowPatient delves into the latest Google Trends figures to reveal a dramatic uptick in American interest around cutting-edge weight-management treatments. Our deep dive shows how searches for medications like Zepbound (tirzepatide) and Wegovy (semaglutide) are skyrocketing coast to coast, highlighting regional hotspots, emerging consumer concerns about cost and access, and a nationwide shift toward metabolic-health solutions. From Hawaii’s surging Wegovy queries to Nebraska’s growing fascination with Zepbound, this data-driven overview uncovers the signals of a true weight-loss revolution across the United States.

Obesity is now widely recognized as a chronic disease, with organizations such as the American College of Physicians setting guidelines for its management and emphasizing the need for long-term treatment strategies.

Google Trends showing search interest over time for Zepbound and Wegovy

Key Takeaways

States with the most Wegovy Searches

- Hawaii

- North Carolina

- Mississippi

- Alaska

- Vermont

States with the most Zepbound Searches

- Nebraska

- Indiana

- Missouri

- Connecticut

- Kansas

Image showing Searches for Eli Lilly’s Zepbound by State

Image showing Searches for Novo Nordisk’s Wegovy by State

These search patterns hint at a broader transformation in how Americans approach metabolic health and weight management, and the implications for policymakers, medical practitioners, and patients are substantial.

Regional Dynamics: Zepbound vs. Wegovy Weight Loss Drugs

Google Trends’ state-by-state breakdown paints a clear contrast between the two drugs. Zepbound, still relatively new to the market, has found its strongest following in the Midwest, especially Nebraska, followed by Indiana, Missouri, Connecticut, and Kansas. The intensity of searches (darker blue on the map) reflects widespread consumer curiosity and suggests that Zepbound’s profile is rapidly rising.

In contrast, Wegovy’s fervor is more geographically concentrated. Hawaii tops the list of states most frequently querying “Wegovy,” with North Carolina, Mississippi, Alaska, and Vermont close behind. The deep red hues on the map indicate pockets of especially strong interest, possibly driven by localized health campaigns or demographic factors in these regions.

Trends Over Time: A Sustained Weight Loss Surge

Over the past year, both medications have seen significant search volume growth. Zepbound’s online interest has climbed steadily, peaking in early 2025, while Wegovy’s search frequency, though more variable, remains robust. Rather than a fleeting spike, these patterns represent a sustained engagement, underscoring their growing roles in the national conversation on weight and metabolic health.

What People Are Searching For

Delving into related queries provides a window into consumer priorities:

-

- Zepbound: Users increasingly search for “Zepbound natural recipe,” “Zepbound savings card 2025,” and “Zepbound coupon 2025,” with some terms surging by over 2,000%. Interest in “Zepbound self-pay” and off-label applications like “Zepbound for sleep apnea” highlights both cost concerns and exploratory uses. Zepbound is a prescription drug, and some searches reflect interest in off-label uses of this drug.

Most common related queries for Zepbound

- Zepbound: Users increasingly search for “Zepbound natural recipe,” “Zepbound savings card 2025,” and “Zepbound coupon 2025,” with some terms surging by over 2,000%. Interest in “Zepbound self-pay” and off-label applications like “Zepbound for sleep apnea” highlights both cost concerns and exploratory uses. Zepbound is a prescription drug, and some searches reflect interest in off-label uses of this drug.

-

- Wegovy: Prominent related searches include “Wegovy savings card 2025” and “Wegovy coupon 2025,” growing by more than 4,000%. Queries like “Novocare pharmacy Wegovy” and “HERS Wegovy” point to consumers actively seeking affordable purchase options and specialized services. Wegovy is also a prescription drug, and related queries sometimes indicate interest in off-label uses of this drug.

Most common related queries for Wegovy

Most common related queries for Wegovy

- Wegovy: Prominent related searches include “Wegovy savings card 2025” and “Wegovy coupon 2025,” growing by more than 4,000%. Queries like “Novocare pharmacy Wegovy” and “HERS Wegovy” point to consumers actively seeking affordable purchase options and specialized services. Wegovy is also a prescription drug, and related queries sometimes indicate interest in off-label uses of this drug.

GLP-1 and Its Role in Weight Loss

GLP-1 receptor agonists (GLP-1RAs), a groundbreaking class of medications, are transforming the landscape of weight loss and obesity treatment. Serving as the active components in popular therapies like Wegovy and Zepbound, GLP-1RAs are ushering in a new chapter in obesity medicine. This naturally occurring hormone, which plays a vital role in regulating appetite and stabilizing blood sugar, has become a game-changer for individuals aiming to shed pounds and enhance their metabolic well-being.

Zepbound also has the added benefit of being combined with a glucose-dependent insulinotropic polypeptide receptor agonist (GIP RA).

GLP-1 medications work by mimicking the body’s own hormone, helping to reduce appetite and slow the rate at which the stomach empties. This dual action not only helps patients feel fuller for longer but also supports significant weight loss, often far beyond what’s achievable with diet and exercise alone. Clinical trials have shown that many patients using GLP-1 medications can lose a substantial portion of their body weight, with some studies reporting reductions of up to 20%. For those who have struggled with other weight loss medications or even bariatric surgery, these results represent a major breakthrough.

But the benefits of GLP-1 medications extend well beyond the scale. By improving glycemic control, these drugs help lower blood sugar levels, which is especially important for patients with type 2 diabetes. They have also been shown to reduce blood pressure and lower the risk of chronic diseases such as heart disease, kidney disease, and liver disease. For patients carrying excess weight and facing related health risks, GLP-1 medications offer a comprehensive approach to weight management and metabolic health.

Despite their efficacy, GLP-1 medications are not without drawbacks. Gastrointestinal side effects like nausea can affect many patients, and the self-pay or out-of-pocket costs, often ranging from $900 to $1,350 per month, can be a significant barrier to access, especially for those without comprehensive insurance coverage. As a result, affordability and access remain top causes of concern for both patients and healthcare providers.

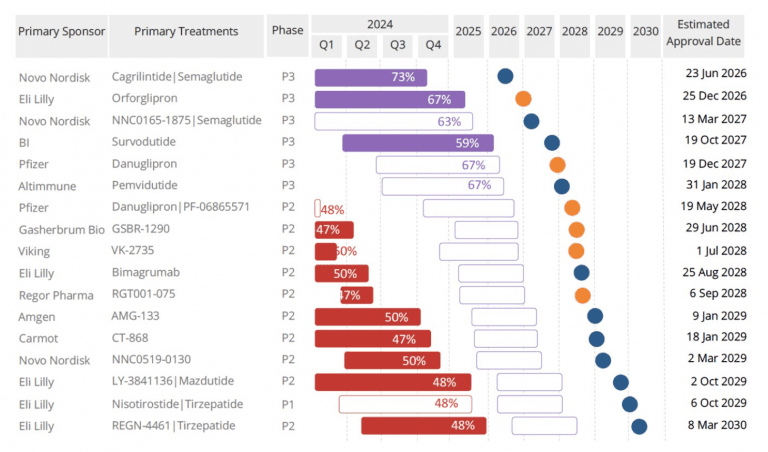

The pharmaceutical industry is responding to this demand, with multiple companies racing to develop new GLP-1 formulations and combination therapies that may offer even greater weight loss with fewer side effects. Eli Lilly’s Zepbound, for example, has garnered attention for its ability to deliver significant weight loss and improved glycemic control, while potentially minimizing some of the gastrointestinal discomfort seen with other agents.

Obesity medicine specialists, including those interviewed by ABC News, have called GLP-1 medications a “big deal” in the fight to treat obesity and its associated health risks. As new data continues to emerge, the medical community is optimistic that these medicines will help more patients achieve lasting, meaningful weight loss and better long-term health outcomes and hopefully with lesser side effects.

Looking ahead, the next phase of obesity medicine will likely see GLP-1 medications used in combination with other weight loss agents, as well as expanded research into their effects on conditions like high blood pressure, heart attack risk, and liver disease. For many patients, these advances represent a new hope in the ongoing challenge of losing weight and maintaining a healthier lifestyle. As the science evolves, GLP-1 medications are poised to remain a cornerstone of effective, evidence-based weight management.

Healthcare Implications of Weight Loss Medications

This wave of online interest signals more than just a buzz, it reflects growing public awareness of novel treatment avenues. While Zepbound and Wegovy were originally approved for weight and metabolic conditions, the breadth of related searches hints at off-label curiosity, from sleep apnea to broader metabolic support.

For healthcare systems, these trends present both challenges and opportunities. Ensuring supply chains can handle increased demand, expanding insurance coverage & access, and educating patients on safe, effective use of weight loss medication will be key. Insurance companies have historically viewed obesity as a cosmetic issue, which limited coverage for weight loss medication. An obesity medicine specialist like NowPatient can help guide patients through treatment options and insurance challenges.

At the same time, regions showing the strongest interest, like Hawaii and Nebraska, could serve as ideal testbeds for targeted treatment programs or subsidy initiatives to tackle access.

Economic and Policy Considerations for Obesity Medicine

Worries such as cost remains top of mind for many searchers. The proliferation of “savings card” and “coupon” queries suggests that affordability could be a barrier without innovative pricing models. More than half of patients discontinue weight loss drugs within a year due to cost or side effects, highlighting the challenge of long-term adherence. A significant portion of patients are impacted by cost barriers, limiting access to these medications. The increased demand for weight loss drugs is creating ripple effects across healthcare policy and economics, influencing reimbursement strategies and public health planning. For example, West Virginia previously had higher prescription rates for weight loss drugs due to broader insurance coverage, but recent policy changes have restricted access and increased disparities. Payers and pharmaceutical companies alike may need to explore new reimbursement strategies to meet patient needs and avoid exacerbating healthcare inequities.

The Digital Marketing Angle

For marketing departments at pharmaceutical companies like Eli Lilly and Novo Nordisk, the surge in specific keywords offers a wealth of opportunity to connect with users. Content strategies that focus on high-interest terms (“Zepbound vs. Wegovy,” “Zepbound savings card 2025,” “Wegovy coupon 2025”) and regional targeting can capture this growing audience. Long-tail phrases such as “Zepbound for sleep apnea treatment” or “Wegovy weight-loss success stories” will help attract niche segments, while social media campaigns using hashtags like #Zepbound2025 and #WegovyHealth can amplify reach.

For pharmaceutical companies this can be a good method to receive meaningful data such as side effects, efficacy and treatment outcomes.

A Pivotal Moment in U.S. Healthcare

The pronounced rise in Google Trends searches for Zepbound and Wegovy underscores a broader national dialogue on weight management and metabolic health. Consumers are actively researching both clinical benefits and cost-saving measures, signaling that demand will likely continue to grow. Collaboration among pharmaceutical companies, healthcare providers, insurers, and policymakers will be essential to translate this digital interest into accessible, effective patient care.

Eli Lilly has emerged as a leader in developing innovative obesity and diabetes treatments, with Eli Lilly’s Zepbound standing out for its superior efficacy. Zepbound uses a dual mechanism involving two hormones, GLP-1 and glucose-dependent insulinotropic polypeptide (GIP), to achieve greater weight loss than single-hormone therapies. Clinical trials have shown that patients can lose up to half of their excess weight with these medications. These drugs can also improve blood vessel health and reduce cardiovascular risk, which is especially important given the serious health implications of being overweight. However, the long-term effects of these medications are still being studied, and more research is needed to fully understand their impact. Weight regain is a concern after discontinuing medication, highlighting the need for ongoing management. Incorporating physical activity and strength training, along with making healthy food choices and focusing on whole foods, is crucial for long-term success in weight management.

As of July 2025, these search trends mark a clear inflection point. The question now is how stakeholders across the healthcare ecosystem will respond to this groundswell of consumer engagement, and whether they can seize the opportunity to improve outcomes for millions of Americans.

How US compares to the rest of the world when it comes to searching Zepbound & Wegovy?

The trend carries over for worldwide searches. In the United States, up until December 2024, the overwhelming search queries were for Wegovy. However, from January 2025 onwards, Zepbound continued to provoke accelerated search interest.

Outside the United States, the story is similar. Up until September 2024, the search queries were very similar showing an even level of interest for Wegovy and Zepbound, which is marketed for weight loss outside of America as Mounjaro. However, from September 2024 onwards, Zepbound/Mounjaro continued to outperform Wegovy-related queries.

One can conclude, therefore, that Zepbound has consistently dominated search interest compared to Wegovy.

Medical Disclaimer

NowPatient has taken all reasonable steps to ensure that all material is factually accurate, complete, and current. However, the knowledge and experience of a qualified healthcare professional should always be sought after instead of using the information on this page. Before taking any drug, you should always speak to your doctor or another qualified healthcare provider.

The information provided here about medications is subject to change and is not meant to include all uses, precautions, warnings, directions, drug interactions, allergic reactions, or negative effects. The absence of warnings or other information for a particular medication does not imply that the medication or medication combination is appropriate for all patients or for all possible purposes.